I submitted all the documents last week why does my accident claim still under review?

This is a common question policyholders ask, and too often, it’s met with silence or vague responses. The reality? Most insurers still rely heavily on manual processes to validate accident claims a task that’s both time consuming and error prone.

In high stress scenarios when a person is injured, a car is totaled, or medical bills are rising speed and clarity are everything. That’s why insurers are turning to intelligent, agentic automation to process accident claims with the speed, accuracy, and transparency today’s customers expect.

The Challenge: Complex, High-Volume Claims and Limited Bandwidth

Insurance claims whether for accidents, major surgeries, maternity care, or routine checkups are far from simple paperwork. Each claim involves a vast array of documents, from emergency medical records and police reports to diagnostic tests, repair invoices, and treatment summaries. Insurers must carefully verify every detail against intricate and ever evolving policy terms, eligibility criteria, coverage limits, and exclusions. This manual process is time consuming, prone to errors, and leaves claims teams overwhelmed and customers waiting anxiously for answers.

With growing volumes and complex policies, insurers struggle to quickly determine who qualifies, how much is payable, and ensure compliance with the latest rules. In today’s customer centric world, delayed or unclear claim decisions hurt trust and satisfaction. Policyholders expect transparency, speed, and fairness especially when they need it most.

It’s time to transform this complexity into simplicity. By embracing intelligent automation, insurers can accelerate claims processing, reduce errors, and deliver a seamless, confident customer experience that sets them apart in a competitive market.

The Solution: AI-Driven Claims Evaluation, Powered by UiPath

At Rapidflow, we help insurers reimagine their claims operations through Agentic Automation leveraging UiPath AI Agents to streamline the end to end insurance claims lifecycle.

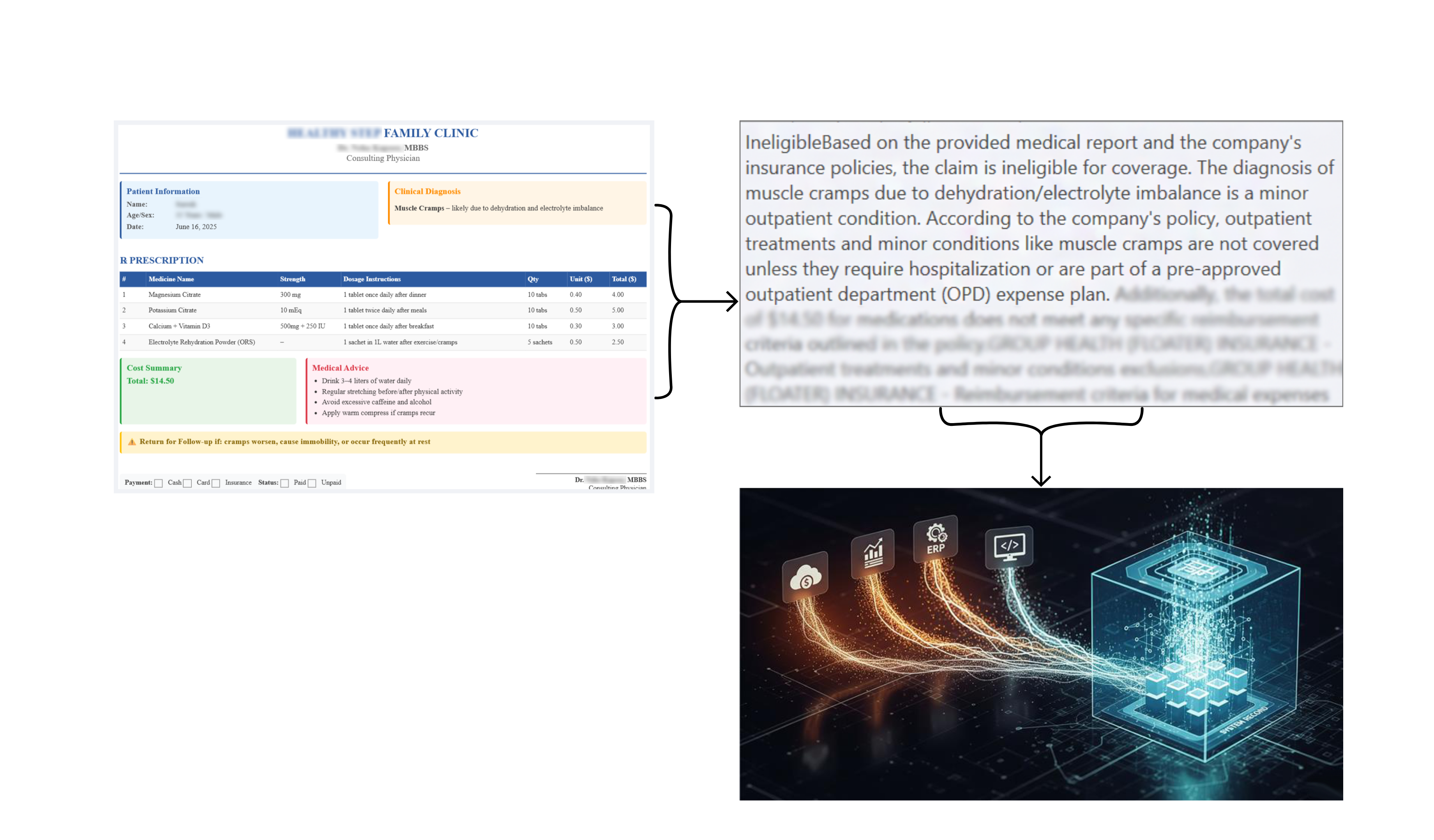

Test Case:

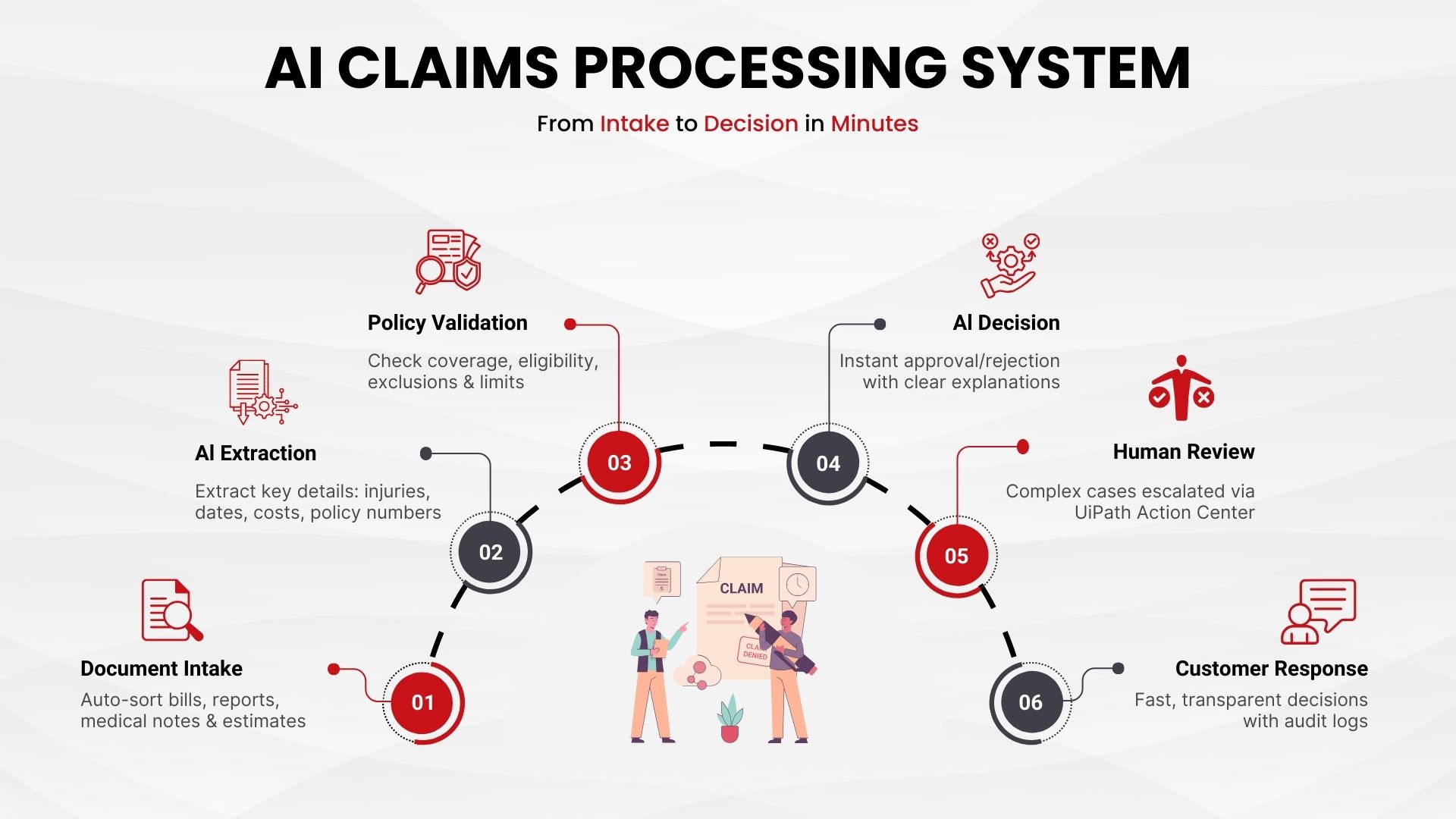

How It Works: From Accident to Approval—In Minutes, Not Weeks

Accidents are stressful. Waiting for claim approvals shouldn’t be.

Our AI powered automation takes over the heavy lifting, so your customers get answers faster—and your teams stay focused on what really matters.

Business Benefits: Faster Claims, Improved Trust

By automating accident claims validation, insurers can unlock measurable improvements in both customer satisfaction and operational performance:

- Faster Claim Turnaround

Reduce claim resolution time by up to 75%, enhancing customer satisfaction during critical moments. - Greater Accuracy & Consistency

Minimize manual errors and ensure consistent application of policy rules across all cases - Enhanced Transparency

Provide policyholders with clear explanations of claim decisions backed by data and documented logic - Scalable Operations

Handle surges in claim volumes such as post holiday accidents or extreme weather events without increasing team size. - Human Oversight Where It Matters

Low confidence or ambiguous cases are escalated to human reviewers via UiPath Action Center, ensuring fairness and control in complex scenarios.

Redefine The Claims Experience

Today’s policyholders expect more than just coverage they expect speed, transparency, and fairness. With Agentic Automation, you can deliver all three.

Let Rapidflow and UiPath help you modernize insurance claims processing so your operations run smarter, and your customers stay happier.